One of the most important tasks facing a small business is

keeping watch over the money flowing into its coffers and out to

its vendors, employees and advisors. Fortunately, today's

full-featured-yet inexpensive-accounting programs allow business

owners to track and manage every aspect their companies'

finances. And by automating income and expense information, a

business can reduce its accounting expenses and save its accounting

firm time and effort.

"The key to managing a business is knowing how it's doing by keeping accurate income and expenses records," says Eugene A. Schnyder, a CPA and emerging enterprise consultant in Shushan, New York. Even a moderately successful emerging business, however, soon outgrows cash-drawer/checkbook recordkeeping. The cash balance at the end of the day doesn't tell how well a business is doing, nor does it help in making business decisions. In the past, accounting records were maintained by hand, in columnar ledgers, which involved tallying transaction totals at the end of each week or month. A computerized accounting system can track and analyze considerably more information than a manual record system-and with less effort.

John Eason owns and operates Southeastern Sales & Specialties Inc. and Advanced Distribution Technologies Inc., software development and distribution companies in Carrollton, Georgia. "A typical start-up company tends to rely on its owner's ability to 'keep the figures' in his or her head," Eason says. "As the company grows, the owner's time is diverted from his or her area of expertise and to the areas he or she is usually less capable or experienced in-accounting, collections, determining costs and so on. The single most important factor for most businesses is cash flow and the ability to manage it properly.

Most small-business owners don't know their true costs of doing business because they don't accurately track or monitor all the costs. They tend to discount their time and profits because of this. Small companies do the same things and need the same information as large companies. Selecting the proper accounting software can save most of the accounting costs incurred by a company and will give its banker confidence in the company's ability to provide proper, timely and accurate financial information."

LEARNING THE TERMS

To choose the right accounting software for your business, you should understand these basic accounting terms:

Asset-A tangible or intangible object of value to its owner.

Liability-An obligation to another party.

Income-Money received for goods or services produced or as a return on investment.

Expense-Money spent for goods or services.

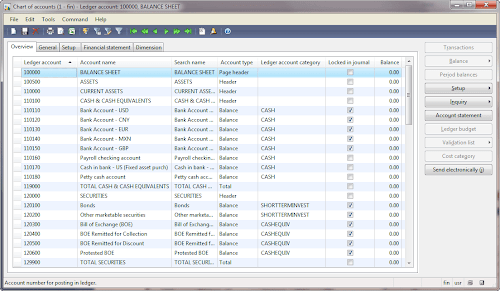

General Ledger-The main records of the assets, liabilities, income and expenses of an organization.

Accounts Payable-A company liability; amounts due to suppliers of goods or services.

Accounts Receivable-A company asset; amounts owed for goods or services that have been supplied.

Capital-The net worth of the company; the assets less the liabilities.

Double-entry accounting-A system in which the total of all left-side entries is offset by an equal total of right-side entries. Left-side entries are known as debits, and right-side entries are known as credits. A debit or a credit can be applied to any general ledger account, whether it's an asset, a liability, capital, income or an expense.

FINDING THE SOFTWARE THAT FITS YOUR NEEDS

The best way to select an accounting program is to match your company's needs against popular accounting programs. A typical program will contain modules, or sections of a program, that cover particular accounts, such as accounts payable, accounts receivable, invoicing, inventory, payroll, banking and so on. The best software includes modules you can use to track your contacts and your schedule, to maintain a list of tasks and reminders and to perform mail-merges for form letters and labels.

Schnyder offers the following suggestions for choosing a suitable accounting software program:

Purchase an off-the-shelf commercial or shareware package rather than a custom program, because most of the bugs have already been removed. Most off-the-shelf programs also provide a good user's manual, a strong help system and support services.

Get a recommendation from your CPA. Also check with members of local business organizations and other small-business owners.

Look for software that's easy to set up. Some programs ask questions about your business and use the answers to create the first records and to enable features suitable for your business. A program should be easy to customize so you can select features appropriate for your business and remove features you don't need.

Consider software created specifically for your type of business. If you run a pet store, for example, look for a program that provides features for retailers or even specifically for pet stores. Shareware is the best source for business-specific accounting programs. For names and addresses of Web sites from which you can download share-ware programs, see the June 1997 "Computer Ease" column.

Schnyder also recommends asking yourself the following questions:

Does the software provide all the functions you need? For example, if your company maintains an inventory of supplies or goods produced, the program should include an adequate inventory-management system.

What monthly reports and journals does the program produce? Can you customize them for your business? Can you create new reports without too much effort?

As your business grows, can you easily move from your current software to a more advanced version?

You don't want to have to enter data more than once, so your accounting program should be able to share data with other programs on your computer. For example, look for a program that can import data from and export data to your spreadsheet program. Or if you want to insert financial reports into documents such as proposals or business plans, make sure your accounting program can export data to your word processor.

Can the accounts receivable, accounts payable, payroll, inventory and other modules communicate with each other and easily pass information back and forth?

"Accounting software should be completely integrated," Eason says. "Too many companies purchase an accounting package and try to 'marry it' to another program to make it complete. An accounting program should be true double-entry, interfaced with other modules (such as inventory, purchasing, sales order/invoicing and so on). A business needs to be able to keep track of all the operations it uses to perform its work as the work is being performed. I searched for an accounting package that contained most of the features and capabilities of the accounting systems I used when I worked for large companies."

USING THE INTERNET TO SEND AND RECEIVE FINANCIAL DATA

More and more clients and accountants send and receive data using the Web. Some accounting programs provide built-in Internet access, and accounting firms use client write-up programs to send and receive financial information to and from clients, banks and government agencies. "I believe the Internet and programs that utilize the latest technology are going to dramatically change the way accountants deliver service to small businesses," says Myron Joy, a CPA who operates Joy & Associates CPAs, PC, in Phoenix. "Using Internet connections, businesses will send financial information from their accounting programs to their accountants' offices for completion of traditional accounting functions. Then the accountants will arrange tax deposits and payments and download bank account information-all online. The completed financial reports and accounting data will be sent to the client via the Internet to his Web site or e-mail address. The efficiency of this type of delivery system will lower the clients' overall costs. Joy & Associates has developed ClientLink Write-Up, a program that gives the accountant the features to implement such a service." Other developers of write-up programs for accountants include Creative Solutions (http://www.csisolutions.com/),

Drake Software (http://www.drake-software.com)

UniLink (http://www.unilink-inc.com/).

BENEFITS OF A COMPUTERIZED ACCOUNTING SYSTEM

Computerized accounting systems are well worth the investment. Schnyder sums it up: "The initial entry of records into a computer accounting system is just as time-consuming as it is in a manual system. A byproduct of computer record-keeping, however, is the capability for analysis, accuracy and quick retrieval of searched-for records."

Contact Sources

Advanced Distribution Technologies Inc.,

http://www.the-information-age.com/business/adt

Joy & Associates CPAs PC, (602) 468-1284, http://www.joycpa.com/

Southeastern Sales & Specialties Inc.,

http://www.the-information-age.com/business/sss

Ref : http://www.entrepreneur.com/article/23098

"The key to managing a business is knowing how it's doing by keeping accurate income and expenses records," says Eugene A. Schnyder, a CPA and emerging enterprise consultant in Shushan, New York. Even a moderately successful emerging business, however, soon outgrows cash-drawer/checkbook recordkeeping. The cash balance at the end of the day doesn't tell how well a business is doing, nor does it help in making business decisions. In the past, accounting records were maintained by hand, in columnar ledgers, which involved tallying transaction totals at the end of each week or month. A computerized accounting system can track and analyze considerably more information than a manual record system-and with less effort.

John Eason owns and operates Southeastern Sales & Specialties Inc. and Advanced Distribution Technologies Inc., software development and distribution companies in Carrollton, Georgia. "A typical start-up company tends to rely on its owner's ability to 'keep the figures' in his or her head," Eason says. "As the company grows, the owner's time is diverted from his or her area of expertise and to the areas he or she is usually less capable or experienced in-accounting, collections, determining costs and so on. The single most important factor for most businesses is cash flow and the ability to manage it properly.

Most small-business owners don't know their true costs of doing business because they don't accurately track or monitor all the costs. They tend to discount their time and profits because of this. Small companies do the same things and need the same information as large companies. Selecting the proper accounting software can save most of the accounting costs incurred by a company and will give its banker confidence in the company's ability to provide proper, timely and accurate financial information."

LEARNING THE TERMS

To choose the right accounting software for your business, you should understand these basic accounting terms:

Asset-A tangible or intangible object of value to its owner.

Liability-An obligation to another party.

Income-Money received for goods or services produced or as a return on investment.

Expense-Money spent for goods or services.

General Ledger-The main records of the assets, liabilities, income and expenses of an organization.

Accounts Payable-A company liability; amounts due to suppliers of goods or services.

Accounts Receivable-A company asset; amounts owed for goods or services that have been supplied.

Capital-The net worth of the company; the assets less the liabilities.

Double-entry accounting-A system in which the total of all left-side entries is offset by an equal total of right-side entries. Left-side entries are known as debits, and right-side entries are known as credits. A debit or a credit can be applied to any general ledger account, whether it's an asset, a liability, capital, income or an expense.

FINDING THE SOFTWARE THAT FITS YOUR NEEDS

The best way to select an accounting program is to match your company's needs against popular accounting programs. A typical program will contain modules, or sections of a program, that cover particular accounts, such as accounts payable, accounts receivable, invoicing, inventory, payroll, banking and so on. The best software includes modules you can use to track your contacts and your schedule, to maintain a list of tasks and reminders and to perform mail-merges for form letters and labels.

Schnyder offers the following suggestions for choosing a suitable accounting software program:

Purchase an off-the-shelf commercial or shareware package rather than a custom program, because most of the bugs have already been removed. Most off-the-shelf programs also provide a good user's manual, a strong help system and support services.

Get a recommendation from your CPA. Also check with members of local business organizations and other small-business owners.

Look for software that's easy to set up. Some programs ask questions about your business and use the answers to create the first records and to enable features suitable for your business. A program should be easy to customize so you can select features appropriate for your business and remove features you don't need.

Consider software created specifically for your type of business. If you run a pet store, for example, look for a program that provides features for retailers or even specifically for pet stores. Shareware is the best source for business-specific accounting programs. For names and addresses of Web sites from which you can download share-ware programs, see the June 1997 "Computer Ease" column.

Schnyder also recommends asking yourself the following questions:

Does the software provide all the functions you need? For example, if your company maintains an inventory of supplies or goods produced, the program should include an adequate inventory-management system.

What monthly reports and journals does the program produce? Can you customize them for your business? Can you create new reports without too much effort?

As your business grows, can you easily move from your current software to a more advanced version?

You don't want to have to enter data more than once, so your accounting program should be able to share data with other programs on your computer. For example, look for a program that can import data from and export data to your spreadsheet program. Or if you want to insert financial reports into documents such as proposals or business plans, make sure your accounting program can export data to your word processor.

Can the accounts receivable, accounts payable, payroll, inventory and other modules communicate with each other and easily pass information back and forth?

"Accounting software should be completely integrated," Eason says. "Too many companies purchase an accounting package and try to 'marry it' to another program to make it complete. An accounting program should be true double-entry, interfaced with other modules (such as inventory, purchasing, sales order/invoicing and so on). A business needs to be able to keep track of all the operations it uses to perform its work as the work is being performed. I searched for an accounting package that contained most of the features and capabilities of the accounting systems I used when I worked for large companies."

USING THE INTERNET TO SEND AND RECEIVE FINANCIAL DATA

More and more clients and accountants send and receive data using the Web. Some accounting programs provide built-in Internet access, and accounting firms use client write-up programs to send and receive financial information to and from clients, banks and government agencies. "I believe the Internet and programs that utilize the latest technology are going to dramatically change the way accountants deliver service to small businesses," says Myron Joy, a CPA who operates Joy & Associates CPAs, PC, in Phoenix. "Using Internet connections, businesses will send financial information from their accounting programs to their accountants' offices for completion of traditional accounting functions. Then the accountants will arrange tax deposits and payments and download bank account information-all online. The completed financial reports and accounting data will be sent to the client via the Internet to his Web site or e-mail address. The efficiency of this type of delivery system will lower the clients' overall costs. Joy & Associates has developed ClientLink Write-Up, a program that gives the accountant the features to implement such a service." Other developers of write-up programs for accountants include Creative Solutions (http://www.csisolutions.com/),

Drake Software (http://www.drake-software.com)

UniLink (http://www.unilink-inc.com/).

BENEFITS OF A COMPUTERIZED ACCOUNTING SYSTEM

Computerized accounting systems are well worth the investment. Schnyder sums it up: "The initial entry of records into a computer accounting system is just as time-consuming as it is in a manual system. A byproduct of computer record-keeping, however, is the capability for analysis, accuracy and quick retrieval of searched-for records."

Contact Sources

Advanced Distribution Technologies Inc.,

http://www.the-information-age.com/business/adt

Joy & Associates CPAs PC, (602) 468-1284, http://www.joycpa.com/

Southeastern Sales & Specialties Inc.,

http://www.the-information-age.com/business/sss

Ref : http://www.entrepreneur.com/article/23098